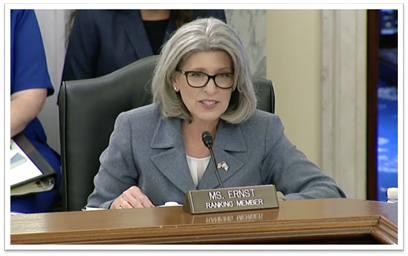

Ranking Member Ernst Delivers on Childcare, Veteran Support, and Accountability at the SBA

WASHINGTON – Today, U.S. Senator Joni Ernst (R-Iowa) ushered long-fought efforts through the Senate Small Business Committee to improve access to childcare, support veterans seeking to launch a small business, and boost accountability in lending at the Small Business Administration (SBA).

Watch Ranking Member Ernst’s remarks here.

“As Ranking Member of the Senate Small Business Committee, it is my duty to bring the voice of main street entrepreneurs to Washington,” said Ranking Member Ernst. “After hearing from small business owners and bankers across Iowa, through my work, we’re increasing childcare access, providing opportunities to our veterans, and ensuring SBA’s lending programs safeguard taxpayer funds while supporting community banks. I’m grateful these efforts are one step closer to becoming law, and I will keep fighting on behalf of our job creators!”

Background:

Ranking Member Ernst has long been committed to improving access to childcare, supporting veteran entrepreneurs, and pushing back against the Biden administration’s risky lending rules.

Ernst’s wins for Iowa’s entrepreneurs include:

- The Small Business Child Care Investment Act, which increases the availability of affordable, high-quality childcare to working families by allowing small, non-profit childcare providers, including religiously-affiliated non-profits, to participate in Small Business Administration (SBA) loan programs.

- The Veteran Entrepreneurship Training Act, or VET Act, which codifies the “Boots to Business” initiative under the Small Business Administration (SBA), a pilot program originally launched in 2013 in partnership with the Department of Defense (DOD) designed to help servicemembers and their spouses transitioning out of the military acquire the tools to succeed as small business owners.

- The Community Advantage Loan Program Act of 2023, which puts critical safeguards in place for the Small Business Lending Company (SBLC) program, strengthens the SBA’s Office of Credit Risk Management to protect taxpayer dollars, and incentivizes lenders to focus on small-dollar lending.

###